student loan debt relief tax credit for tax year 2020

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Have incurred at least 20000 in undergraduate andor graduate student loan debt.

Student Loans In The United States Wikipedia

Were eligible for in-state tuition.

. Ii has at least 5000 in outstanding undergraduate or graduate student loan debt or both when submitting an application under subsection c of this section. In Indiana for example the state tax rate is 323. The Maryland Higher Education Commissionmay request additional.

Have the debt be in their the Taxpayers name. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. In Indiana for example the state tax rate is 323.

The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. I request federal student loan debt relief of up to 20000. Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details.

Complete the Student Loan Debt Relief Tax Credit application. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education. A copy of your Maryland tax get back for the most present past tax 12 months. Get Your Custom Debt Relief Plan.

B Subject to the limitations of. The rule is that you get to deduct the lesser of 2500 or the amount of interest you actually paid. Finding an option to settle your tax debt is a lot easier now as the tax relief options available add more potential ways to mitigate tax.

Complete the Student Loan Debt Relief Tax Credit application. Review and Submit the Agreement. Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000.

The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings. For Maryland Residents or Part-year Residents Tax Year 2020 Only. Instructions are at the end of this application.

Under Maryland law the recipient. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. What that means is if you only paid 500 in interest then youll only be able to deduct.

Complete the Student Loan Debt Relief Tax Credit application. If requested I will provide proof of income to the US. Have at least 5000 in outstanding student loan debt upon.

Will have maintained residency within the state of Maryland for the 2020 tax year Have. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

A student mortgage debt settlement income tax loans is actually a program made under 10-740 regarding the Tax-General piece from the Annotated rule of Maryland to supply. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Student Loans Aren T Going Away Any Time Soon So What S Next

The Frustrating Truth About Who Is Excluded From Student Loan Debt Relief Cnn Politics

After President Biden Cancels Student Debt Center For American Progress

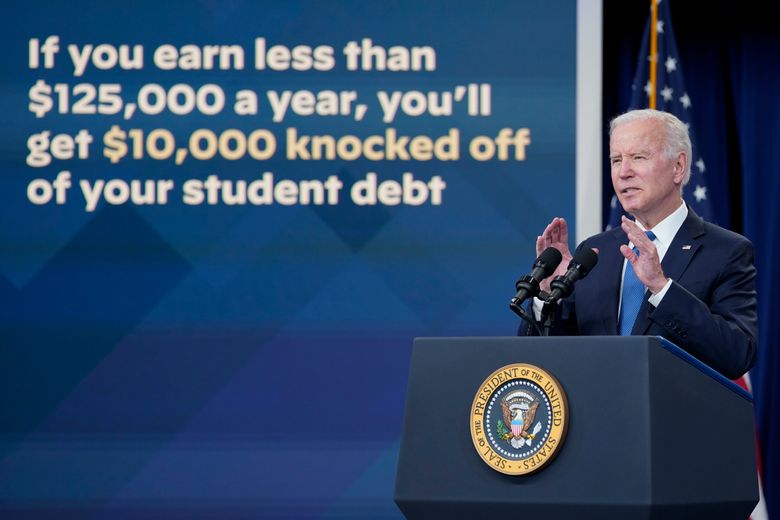

President Announces Student Loan Forgiveness Eligibility Details Application And Tax Implications Wolters Kluwer

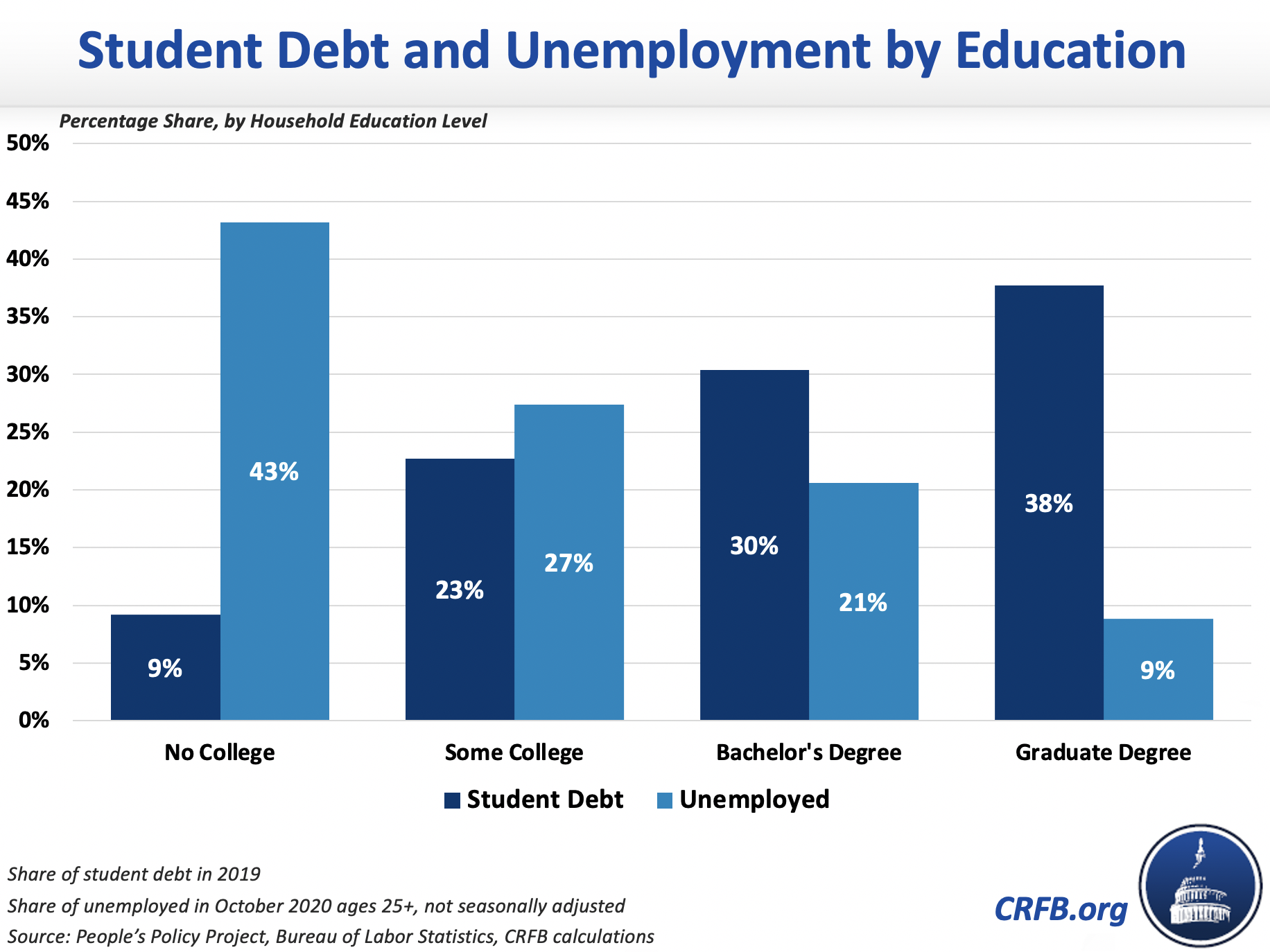

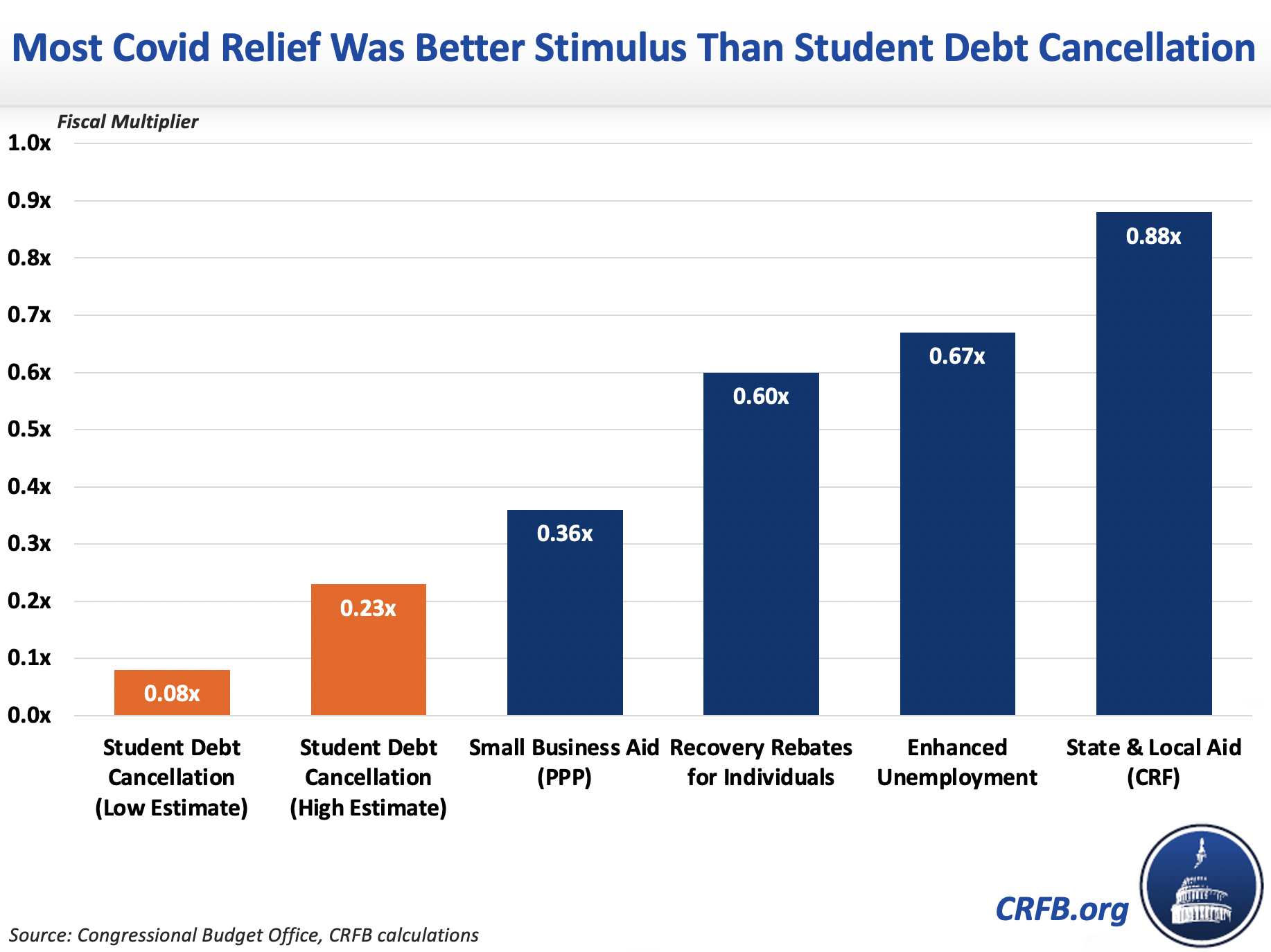

Canceling Student Loan Debt Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Why Student Debt Forgiveness Won T Include Higher Tax Bills Tax Policy Center

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loan Debt Cancellation And Taxes Kiplinger

The Impact Of Filing Status On Student Loan Repayment Plans The Tax Adviser

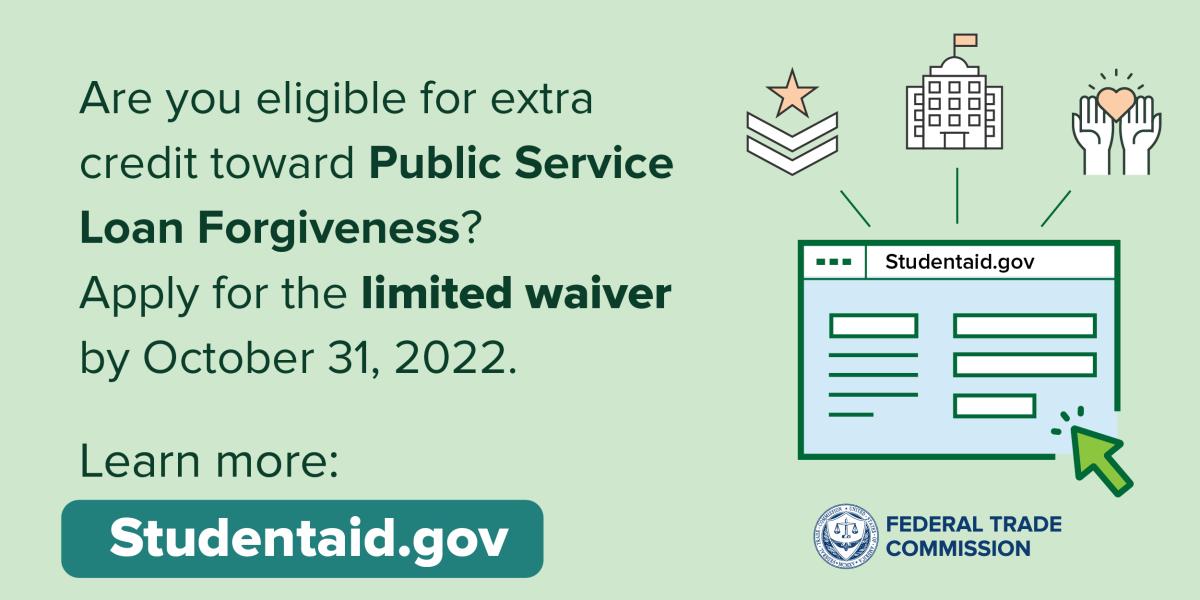

Limited Waiver For Student Loan Forgiveness Ends October 31 Consumer Advice

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

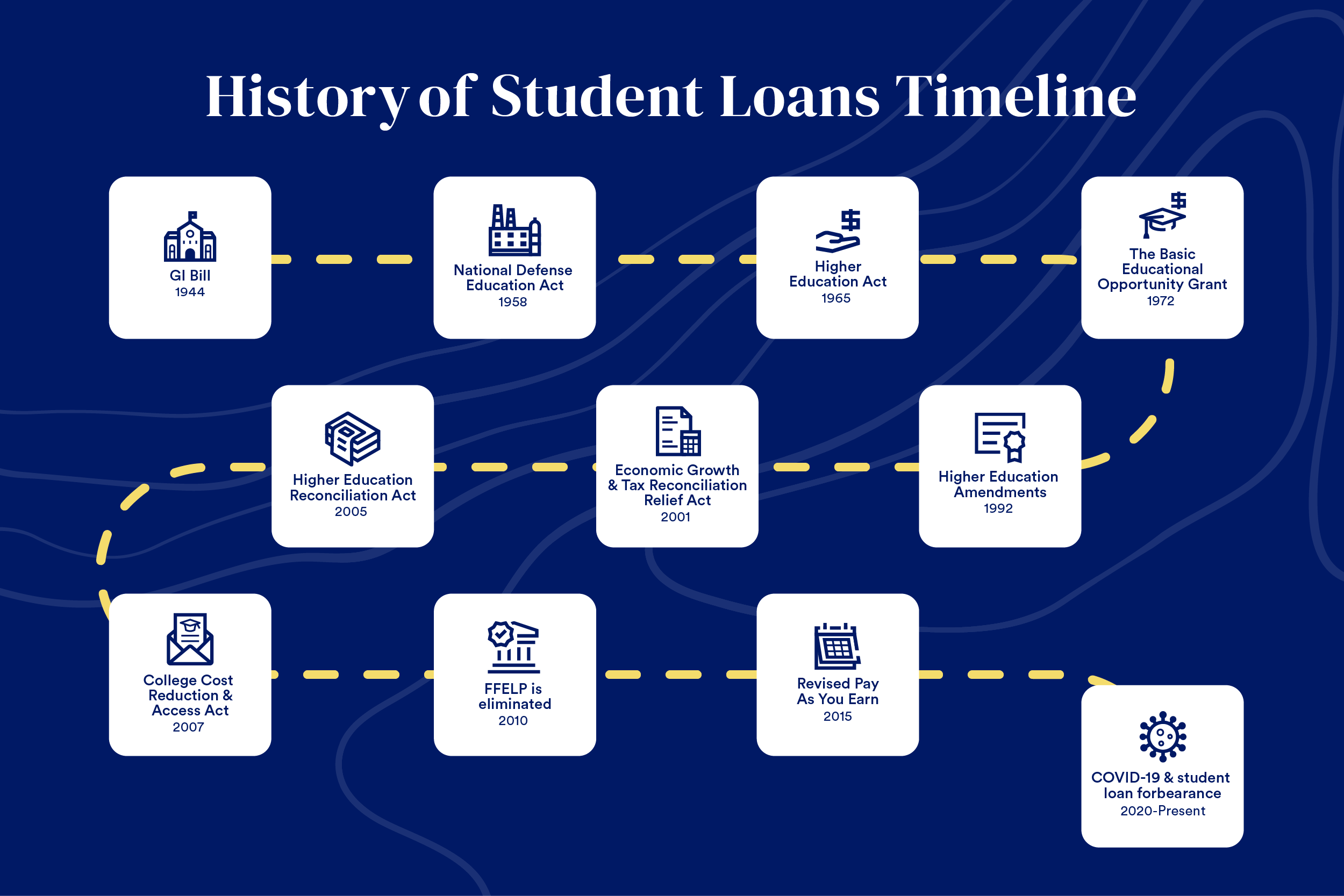

The Complete History Of Student Loans Bankrate

See How Average Student Loan Debt Has Changed In 10 Years

The Case Against Student Loan Forgiveness

Canceling Student Loan Debt Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Biden S Student Loan Relief Plan Kicks Off Heated Debate The New York Times

How To Apply For Biden S Student Loan Forgiveness 2022 Kiplinger